To get pre-approved for a mortgage, contact a lender and submit your financial information. This process helps you understand the loan amount you qualify for.

Starting your journey towards homeownership is thrilling and securing a mortgage pre-approval is a crucial step. This initial assessment by a lender evaluates your creditworthiness based on financial data, including income, debts, and credit history. Gaining pre-approval boosts your buying credibility and narrows your home search to properties within your budget.

It’s essential to prepare documents like pay stubs, tax returns, and bank statements before approaching lenders. An effective pre-approval gives you the confidence to bid on homes with a clear understanding of your financial limitations and shows sellers you’re a serious competitor in the market. Aim for this financial green light early in your house-hunting adventure for a smoother, more targeted quest for your dream home.

Helping People Achieve Their Dream Of Homeownership!

👉 Simone Castello MLO (NMLS: 2181703)

📧 scastello@certifiedhomeloans.com

📞 WhatsApp No: +1 954-483-7742

Table of Contents

Introduction To Pre-approval For Mortgages

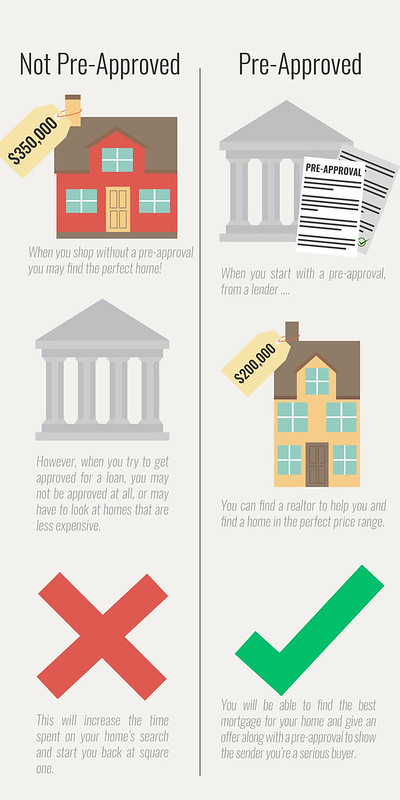

Stepping into the housing market? Pre-approval for a mortgage marks the start of your home-buying journey.

This pivotal step shows how much a lender might offer based on your finances. Without it, that dream home could slip through your fingers.

Smooth the path to your new home by understanding and securing your pre-approval.

The Importance Of Pre-approval In The Home Buying Process

Pre-approval sets a clear budget for your house hunt. Sellers see you as a serious buyer. It speeds up the purchase once you find the right place. You need it to stay competitive in today’s market.

The Basics Of Mortgage Pre-approval

Start with your financial records: income, debts, and assets. Lenders check your credit score and history. They calculate what you can borrow. This is your chance to explore loan options.

Credit Score And History Requirements

Are you ready for homeownership? Your credit score and history are key factors. Lenders check these to see if you can get a mortgage. Let’s explore what scores you need and how to boost them before you apply.

Understanding Your Credit Score

Your credit score is a three-digit number. Lenders use it to guess if you will pay back loans. Scores range from 300 to 850. A higher score means better chances for mortgage pre-approval. Most lenders want at least a 620 score. Some special loans might let you have a lower score.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loan | 620+ |

| FHA Loan | 580+ |

| VA Loan | Varies |

| USDA Loan | 640+ |

How To Improve Your Credit History Before Application

Boosting your credit history is a must. A good history shows lenders you are a safe bet. Start this at least six months before you want to apply.

- Pay bills on time. Late payments hurt your score.

- Lower your debt. Use less than 30% of your credit limit.

- Check your credit report. Fix any mistakes you find.

- Keep old credit accounts open. They show a long credit history.

- Avoid new credit accounts. They can lower your average account age.

Take these steps and watch your score climb. A better score means a smoother mortgage process. It might even get you lower interest rates. Start now and make your home dream real. Success waits for you.

Gathering Necessary Documentation

Embarking on the journey of home ownership begins with one crucial step: getting pre-approved for a mortgage. Before lenders give their nod of approval, prospective buyers must gather a trove of documents. This paperwork trail is the key to unlocking the door to your mortgage pre-approval. Let’s delve into the documents you’ll need to compile.

Income Verification Documents

To start, you’ll need to prove your income. Lenders want to be sure you can afford your mortgage payments. Gather your most recent pay stubs, W-2 forms from the past two years, and if you’re self-employed, your tax returns from the past two years will be essential. This helps the lender calculate your debt-to-income ratio, a critical factor in determining your loan eligibility.

Asset Documentation

Your assets show lenders you have the funds for the down payment and closing costs. Bank statements and investment account records from the last two or three months are typical requests. Be prepared to explain any large deposits to ensure they weren’t loans that could affect your debt levels.

Other Required Paperwork

Beyond income and assets, you’ll need a valid photo ID to confirm your identity and a Social Security number for a credit check. If you’re a homeowner already, prepare to present your current home’s mortgage statement. Renters should have a landlord’s contact info ready for a rental history verification.

- Government-issued photo ID (e.g., driver’s license or passport)

- Social Security card or number for credit inquiries

- Current mortgage statements or landlord’s contact details

Choosing The Right Lender For Pre-approval

When starting your journey to home ownership, picking the perfect lender for a mortgage pre-approval is a crucial step. Your choice could affect your interest rate, loan terms, and overall experience. Let’s walk through the process of comparing mortgage lenders to find the right match for your financial situation.

Comparing Different Mortgage Lenders

Every lender offers unique benefits. Some have lower rates; others provide excellent customer service. To compare lenders effectively:

- Look at their interest rates and fees.

- Read reviews to gauge customer satisfaction.

- Check their loan product variety.

- Ask about closing timelines.

- Research their pre-approval process.

This comparison helps you pick a lender tailored to your needs.

Traditional Banks Vs. Online Lenders

Traditional banks are known for their in-person support. They often offer:

- Face-to-face interactions with loan officers.

- Services like checking and savings accounts.

- Physical locations for easy access.

Contrastingly, online lenders might provide:

- Convenience with online applications.

- Generally lower rates.

- Quicker pre-approval processes.

Decide which features are most important for you.

The Application Process

Embarking on the journey of home ownership begins with paperwork – the mortgage application process. Understanding how to navigate this initial phase is crucial. It streamlines the path to getting that sweet pre-approval notice. Let’s walk through the steps essential to filling out a mortgage application and sidestep some common pitfalls.

Steps To Fill Out A Mortgage Application

- Gather Necessary Documents: Start with your income proof, tax returns, and bank statements.

- Choose the Right Mortgage Type: Decide whether a fixed-rate or adjustable-rate mortgage suits you best.

- Contact Lenders: Reach out to multiple lenders to explore interest rates and terms they offer.

- Complete the Form: Fill every section accurately. Provide personal and financial information.

- Review Before Submitting: Double-check for errors. They could delay or derail your application.

- Submit Application: Send your application to the lenders you’ve chosen.

- Follow Up: Stay in touch with the lender for updates on your application status.

Common Pitfalls To Avoid

- Incorrect Information: One wrong number can affect your loan terms or approval chances.

- Applying for Credit: Avoid taking on new debt. It could lower your credit score.

- Skipping Rate Comparison: Don’t settle for the first offer. Compare rates for the best deal.

- Underestimating Costs: Remember closing costs and additional expenses. Plan your budget accordingly.

- Ignoring Credit Report: Check your credit report beforehand. Resolve any issues to improve your score.

Credit: www.landmarkhw.com

Understanding Pre-approval Letters

Getting a pre-approval for a mortgage is a big step. It shows you mean business when house hunting. A pre-approval letter is your golden ticket. It tells real estate agents and sellers that a lender trusts you with a loan. Let’s dig into what a pre-approval letter is all about.

What Does The Letter Include?

A pre-approval letter is a document from a lender. It states how much loan you might get based on your finances. Here’s what’s inside:

- Loan amount: The max money you could borrow.

- Loan type: It could be fixed-rate or adjustable.

- Interest rate: The cost you pay to borrow.

- Loan term: This says how long you have to pay back.

- Conditions: Things you need to meet for the final approval.

Duration And Expiry Of Pre-approval

Pre-approvals don’t last forever. They usually have a shelf life of 60-90 days. Why? Lenders want to check your finances are still good. Be sure to check the expiry on your letter. Use it before you lose it!

What If Your Financial Circumstances Change?

If your wallet takes a hit or you land a jackpot, tell your lender. A job change or a new car loan can affect your pre-approval. Lenders can update your letter to reflect your new status. It keeps your home buying journey on the straight and narrow.

What To Do Once You’re Pre-approved

Congratulations on your mortgage pre-approval! This critical step paves the way to buying your dream home. Wondering what’s next? Let’s navigate through the strategies to make the most of your pre-approved status.

How To Start House Hunting

- Set Your Budget: Stick to homes within your pre-approval amount.

- Identify Your Needs: List must-haves for your ideal home.

- Choose the Right Neighborhood: Look for safety, schools, and convenience.

- Get a Real Estate Agent: A good agent will match homes to your preferences.

- Schedule Viewings: Visit as many homes as possible to find the perfect fit.

Negotiation Power With Sellers

Present Your Pre-Approval Letter: This demonstrates serious intent and financial readiness. Sellers are more likely to negotiate with pre-approved buyers. You might secure a better deal, especially if there’s less competition.

Keeping Your Pre-approval Valid

Maintain the financial status you had when you got pre-approved. Here’s how:

- Avoid New Debt: Don’t open new credit cards or loans.

- Stay in Your Job: Job stability is key; now’s not the time for a change.

- Keep Saving: More savings can help with down payments and closing costs.

- Don’t Miss Payments: Keep paying bills on time to maintain your credit score.

- Check Pre-approval Expiry: Know your deadline, and renew if necessary.

Mistakes To Avoid After Pre-approval

Getting pre-approved for a mortgage feels exciting! It’s the first giant leap towards owning your dream home. But beware, a few missteps could put that dream at risk. Understanding what not to do after getting pre-approved is just as crucial as the approval itself. Let’s dive into the mistakes to avoid so your path to homeownership is secure.

Taking On New Debt

Lenders review your credit until closing day. Adding new debt signals risk. It might shift your debt-to-income ratio unfavorably. Post-pre-approval, steer clear from:

- Opening new credit cards

- Taking out car loans

- Purchasing big-ticket items on credit

Keep spending in check! Your mortgage depends on it.

Changing Jobs Or Losing Income

Job stability attracts lenders. They need assurance that you can make payments. Think twice before:

- Switching to a lower-paying role

- Quitting your job without another in hand

- Transitioning to self-employment

Maintain your income level. It’s vital for your loan’s final approval.

Forgetting To Lock Your Interest Rate

Rates fluctuate. An unlocked rate could spiral unexpectedly. A lock guarantees your rate for a set period. This means:

- No surprises with monthly payments

- Better financial planning

Discuss rate locks with your lender. Ensure peace of mind as you inch closer to home ownership.

Next Steps: Moving Towards Your Mortgage

Welcome to the journey towards homeownership! Securing a mortgage pre-approval is a significant achievement but only the first step. Understanding what comes after can be quite complicated. The transition from getting pre-approved to actually owning a home involves crucial actions that ensure a smooth process. This blog post aims to guide you through these important next steps, including preparing for additional costs associated with closing on your new home. Let’s dive into the details, so you’re well-prepared and confident as you move forward.

Transitioning From Pre-approval To Applying For A Mortgage

Armed with pre-approval, it’s time to take the next leap.

- Identify potential lenders and compare rates.

- Submit formal mortgage applications to chosen lenders.

- Gather necessary documentation: pay stubs, tax records, etc.

- Maintain your credit score: don’t open new credit accounts.

- Choose the right mortgage type for your situation.

Moving to an actual application is seamless if you stay organized and responsive to lender requests.

Preparing For Closing Costs And Other Fees

Understanding all costs involved avoids last-minute surprises.

| Fee Type | Typical Cost |

|---|---|

| Application Fee | $75 to $300 |

| Appraisal Fee | $300 to $700 |

| Escrow Deposit | 1-2 months of property taxes and mortgage insurance |

| Home Inspection | $300 to $500 |

| Title Search | $200 to $400 |

| Credit Report Fee | $30 to $50 |

Save for these expenses ahead of time and keep your down payment intact. Be prepared for additional costs not listed here. Your lender should give you a Loan Estimate form detailing your closing costs within three business days of receiving your mortgage application.

FAQ on How To Get Pre-approved For A Mortgage

What Is A Mortgage Pre-approval?

A mortgage pre-approval is a lender’s offer to loan you a specified amount under certain terms. It’s based on a thorough review of your financial information. It shows sellers you’re serious and capable of buying a home.

Why Get Pre-approved For A Mortgage?

Getting pre-approved helps you understand how much you can afford, strengthens your offer on a house, and expedites the final loan approval process. It also identifies any potential issues that could hinder your loan approval.

What Documents Do I Need For Pre-approval?

For mortgage pre-approval, you typically need to provide proof of income, employment verification, credit history, and asset documentation. This includes tax returns, W-2s or 1099s, bank statements, and your credit report.

How Long Does Pre-approval Last?

Pre-approval usually lasts for 60 to 90 days. Lenders put an expiration date since your financial situation and credit profile could change. Always check the validity period with your lender.

Conclusion

Securing a pre-approval for your mortgage is a pivotal step towards homeownership. This process clarifies your budget and boosts your bargaining power. Remember, a solid financial standing and the right paperwork are your keys to success. Start your journey home with confidence; a pre-approval letter is your first milestone.

Chase your dream house with the assurance of your pre-set budget.