The amount needed to buy a house varies depending on location and property type. Typically, you should expect to pay around 5-20% of the home’s value as a down payment.

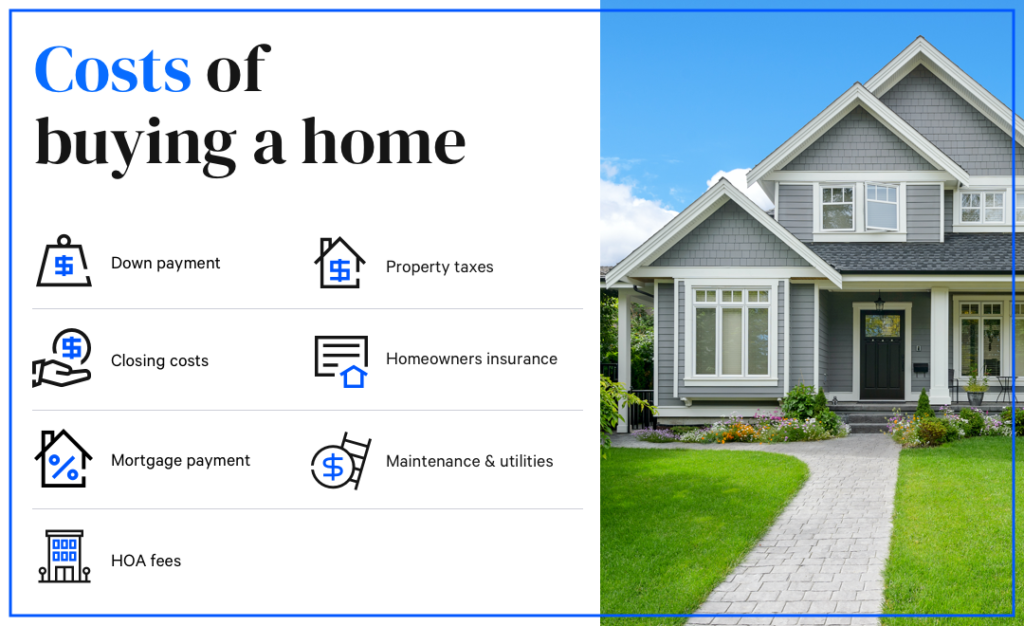

Deciding to purchase a home is a significant financial step that requires thoughtful planning and budgeting. The cost of buying a house extends beyond the list price; it encompasses various expenses such as a down payment, closing costs, moving expenses, home inspections, and potential renovations.

Buyers need to take into account property taxes, homeowners insurance, and possibly private mortgage insurance (PMI), which can affect the overall budget required for a new home. A solid credit score can also help secure a favorable mortgage rate, ultimately impacting the amount needed upfront. It’s essential to consider these factors and budget wisely to ensure that the dream of homeownership doesn’t strain your financial stability.

Helping People Achieve Their Dream Of Homeownership!

👉 Simone Castello MLO (NMLS: 2181703)

📧 scastello@certifiedhomeloans.com

📞 WhatsApp No: +1 954-483-7742

Table of Contents

The Dream Of Homeownership

Buying a house marks a milestone in many people’s lives. It symbolizes stability, success, and security. The idea of owning a home excites many. Yet, understanding the money needed is critical.

Owning a home is more than having a place to live. It’s a long-term investment in your future.

Emotional Vs. Financial Readiness

Buying a home stirs up a mix of emotions. Love for a new home is important, but budget matters too.

Making sure you are ready on both fronts is key. Be sure your heart and your wallet are in the right place.

- Emotional readiness means picturing life in your new home.

- Financial readiness involves having enough money for the purchase.

Evaluating The True Cost Of A Home

The cost of a home is not just the price you pay. It includes many other expenses. Let’s break them down.

| Expense | Description |

|---|---|

| Down Payment | Money you pay upfront. Usually 20% of the home price. |

| Closing Costs | Fees paid at the end of the transaction. Often 2% to 5% of the loan amount. |

| Moving Expenses | Costs to transport furniture and belongings. |

| Home Repair/Improvements | Money for any immediate updates or fixes needed. |

| Property Taxes and Insurance | Annual costs for protecting and owning the property. |

| Maintenance | Regular expenses for keeping the home in good shape. |

Remember, being informed helps in making smart decisions. Know all costs before diving in.

Initial Costs To Anticipate

Thinking about buying a house? Exciting times ahead! But before you start picking out furniture, let’s talk about the initial costs. A house comes with a price tag that goes beyond the listed amount. So, strap in and let’s get financially savvy about the upfront cash you’ll need.

Down Payment Expectations

A down payment is your first major expense. It’s a chunk of change that you pay upfront. It shows lenders you’re serious. It lowers your loan amount too. How much should you save? Aim for 20% of the home’s value. But some loans let you pay as little as 3.5%. Remember, the less you put down, the higher your monthly payments.

| Type of Loan | Minimum Down Payment |

|---|---|

| Conventional | 5% |

| FHA | 3.5% |

| VA | 0% |

Closing Costs And Fees

Think of closing costs as the finale in a homebuying symphony. They include a range of fees. They are for things like appraisals, home inspections, and attorney services. Closing costs typically run between 2% and 5% of your loan amount. Let’s say you’re buying a $300,000 home. Your closing costs could range from $6,000 to $15,000.

- Loan origination fees: The cost to process your loan.

- Title insurance: Protects you from issues with the home’s title.

- Appraisal fee: Puts a price tag on your future home.

- … and many more!

The key? Save more than you think you’ll need. Surprises are great for parties, not closing tables. Start saving early. And stick to your budget. Becoming a homeowner is an exciting journey. And being prepared? That’s your ticket to a smooth ride.

Understanding Mortgage Types

When you start the journey to homeownership, understanding mortgage types is a critical step. Mortgages come in different shapes and sizes, each with its benefits and drawbacks. Knowing what works best for your financial situation can save you thousands of dollars over the lifespan of your loan. Here, we explore the different mortgage types and what they mean for your home buying process.

Fixed-rate Versus Adjustable-rate Mortgages

A key decision in choosing a mortgage is whether to go for a fixed-rate or an adjustable-rate mortgage (ARM). Each type impacts your finances differently over time. Let’s break down the pros and cons:

| Fixed-Rate Mortgage | Adjustable-Rate Mortgage |

|---|---|

|

|

Fixed-rate mortgages lock you into a set interest rate for the entire loan term. ARMs start with a lower rate which changes over time based on the market.

Government-backed Loans Explained

FHA Loans: These require a smaller down payment. They are great for first-time buyers.

VA Loans: Available to veterans. They offer loans with no down payment and no private mortgage insurance.

USDA Loans: Aimed at rural homebuyers. They allow for zero down payment and lower mortgage insurance costs.

Understanding these mortgage types can reveal paths to homeownership that fit your financial situation. Choose the right mortgage and start your home buying journey with confidence.

Estimating Your Budget

Before house hunting, knowing how much money you need is crucial. This process begins with ‘Estimating Your Budget’. By doing this, you can target homes within your financial reach. Doing the math early avoids wasted time on unaffordable properties. Let’s break down the main budget factors now.

Income And Debt Analysis

Understanding your financial health is the first step. Look at monthly income against current debts. This helps figure out how much you can afford for a mortgage. Banks often want your debt-to-income ratio (DTI) to be under 36%. Use the following points to calculate yours:

- Total monthly income: Add up all regular income.

- Monthly debt obligations: Tally loans, credit cards, and other debts.

- DTI ratio: Divide total debts by total income.

In simple terms, if you earn $5,000 a month and debts come to $1,800, your DTI is 36%.

Pre-approval And Loan Estimates

Pre-approval from a lender gives a clear idea of how much they will lend. They check credit history and finances to determine this. Getting pre-approved helps set a realistic budget for your home search. Below are elements typically found in a loan estimate:

| Loan Amount | Interest Rate | Monthly Payment | Closing Costs |

|---|---|---|---|

| The potential mortgage you could receive. | The cost of borrowing the loan amount. | How much you pay the bank each month. | Fees paid at the settlement of the loan. |

Reviewing this estimate outlines initial costs and monthly expenses. Lenders provide these details so you know what to expect financially.

Long-term Financial Planning

Thinking long-term is key when buying a house. Saving for the initial costs like a down payment marks just the beginning. Understanding ongoing expenses will help secure your financial future. Let’s dive into the costs that matter after you get the keys.

Property Taxes And Home Insurance

Property taxes and home insurance are yearly costs. They vary based on location and home value. To plan ahead:

- Research local tax rates.

- Get quotes for home insurance.

- Add these to your annual budget.

Set money aside each month. This ensures taxes and insurance are never a surprise.

Maintenance And Emergency Funds

Maintenance keeps your house in top shape. A well-kept home boosts its value. Besides, setting up an emergency fund covers unexpected repairs. Follow these steps:

- Save 1% of your home’s value for maintenance yearly.

- Build an emergency fund with 3-6 months of expenses.

This planning prevents stress during urgent repairs.

Remember, having funds for taxes, insurance, and upkeep is critical. Smart planning makes homeownership smooth and stress-free.

Exploring Down Payment Assistance Programs

Thinking about buying a house? The big question is, “How much money do I need?” Saving for a home can feel overwhelming, especially the down payment. But worry not! Down Payment Assistance Programs are here to help. Let’s dive into these programs that make homeownership more accessible.

Grants And Subsidized Loans

Grants and subsidized loans can lessen your financial burden. You don’t pay grants back. Subsidized loans have low interest rates. Both options are worth exploring:

- HUD’s HOME Investment Partnerships Program: It provides grants to states and localities.

- Federal Home Loan Bank System: Affordable Housing Program helps with down payments.

Look for local housing agencies too. They often have more grants and loans.

First-time Homebuyer Programs

First-time homebuyer programs are specifically for those new to the market. They offer various benefits:

- FHA Loans: Suitable for low-mid income buyers with lower credit scores.

- USDA Loans: No down payment needed for rural homebuyers.

- VA Loans: Veterans can benefit from no down payment loans.

State programs can add extra help. Check your state’s housing finance agency.

Calculating Additional Homeownership Costs

When you dream of buying a new home, think beyond the sale price. You need to consider all costs. They add to the overall investment. Let’s dive into the fees you might not see coming. These costs are key to budgeting for your new home.

Homeowners Association Fees

Many communities have a Homeowners Association (HOA). This organization manages common areas and services. Monthly or yearly HOA fees could affect your budget. They pay for amenities, maintenance, and sometimes utilities.

- Landscaping

- Snow removal

- Swimming pools

Check the HOA rules and fees before you buy. This ensures you can afford them long-term.

Home Improvement And Renovation Budgeting

Your new home may need upgrades or repairs. Set aside money for these unexpected costs. A renovation budget keeps your finances in check.

| Room | Improvement | Cost Estimate |

|---|---|---|

| Kitchen | New appliances | $5,000-$10,000 |

| Bathroom | Modern fixtures | $3,000-$7,000 |

| Living Room | Flooring | $1,500-$5,000 |

Plan for these expenses. It protects your wallet from surprises.

Making The Decision: To Buy Or To Wait?

Embarking on the journey to homeownership is exciting. Yet, it demands a crucial choice: to dive into the market or to wait. This stage is complex, filled with financial calculations and life plans aligning with your dream home purchase.

Market Conditions And Timing

Market conditions greatly influence your decision to buy a house. Consider these key factors:

- Interest rates: Lower rates mean more affordable loans.

- House prices: Rising prices might urge you to buy sooner.

- Inventory levels: More homes on the market can mean more choices and better prices.

Timing it right could lead to substantial savings. Seek out current trends and forecasts before taking a plunge.

Personal Life Factors And Flexibility

Your personal circumstances are just as important as market conditions:

| Life Factor | Consideration |

|---|---|

| Job stability | Ensure a secure income stream for mortgage payments. |

| Family plans | Think about the space you’ll need in the coming years. |

| Savings level | More savings can cover down payments and unexpected costs. |

Consider flexibility in your plans for location or type of home. This might open up new opportunities within your budget.

FAQ of How Much Money Do You Need To Buy A House?

How Much Is A Typical Home Down Payment?

Down payments for homes generally range from 3. 5% to 20% of the purchase price. First-time buyers often aim for 5-10%, whereas a 20% down payment can waive private mortgage insurance (PMI) costs, leading to long-term savings.

What Are The Average Closing Costs?

Typically, closing costs amount to 2-5% of the home’s purchase price. This includes fees for loan processing, title insurance, and other administrative services. Remember to budget this into your initial costs when buying a house.

Does Credit Score Affect Mortgage Rates?

Yes, your credit score significantly impacts the mortgage rates you’ll qualify for. Higher scores can unlock lower interest rates, which means smaller monthly payments and less paid in interest over the life of the loan.

Are There Hidden Costs In Buying A Home?

There are often hidden costs to account for when buying a house, including home inspections, property taxes, homeowners insurance, maintenance, and potential homeowners’ association fees.

Conclusion

Wrapping up, every potential homeowner’s budget will vary. Calculating the costs for down payment, closing fees, and ongoing expenses is crucial. Start saving early and research financing options to make homeownership a reality. Remember, buying a house is a significant step – plan wisely for a smooth journey to your dream home.