Homeowners should refinance their mortgage to secure lower interest rates and reduce monthly payments. Refinancing can offer significant long-term savings and financial flexibility.

Refinancing a mortgage presents an attractive opportunity for homeowners to improve their financial situation. By taking advantage of lower interest rates, individuals can save thousands over the life of their loan, making it a strategic move for anyone with a higher interest rate than the current market offers.

Quick adjustments to mortgage terms can also lead to more manageable monthly payments, freeing up cash for other investments or expenses. Entering into a mortgage refinance requires understanding the costs involved and the potential benefits, such as shortening the loan’s duration or tapping into home equity. With careful planning, refinancing becomes an essential tool for homeowners to maximize their financial health and stability. It’s a proactive step toward controlling one’s financial destiny in an ever-changing economic landscape.

Helping People Achieve Their Dream Of Homeownership!

👉 Simone Castello MLO (NMLS: 2181703)

📧 scastello@certifiedhomeloans.com

📞 WhatsApp No: +1 954-483-7742

Table of Contents

The Basics Of Mortgage Refinancing

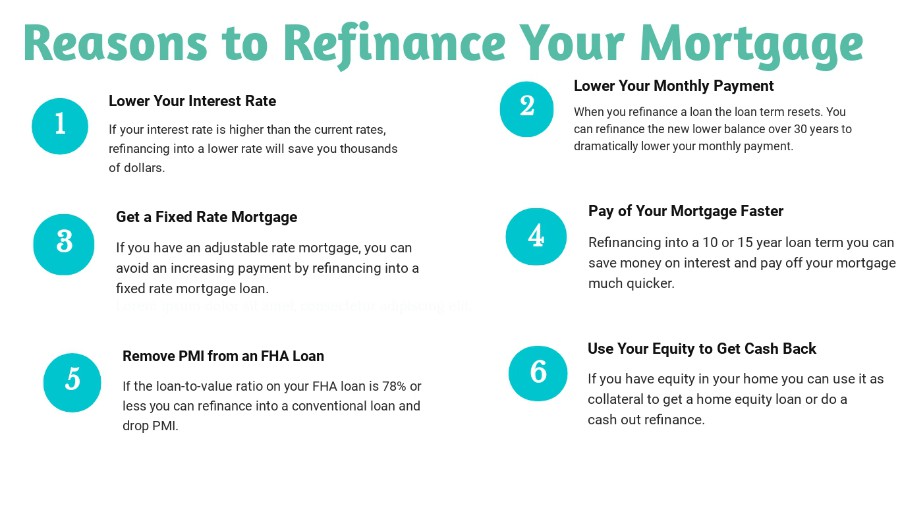

Understanding mortgage refinancing is key for any homeowner. It involves replacing your current mortgage with a new one. This often leads to better interest rates and terms. It can reduce your monthly payments or change the loan’s duration.

Comparing Current Rates To Original Loan Terms

An essential step in refinancing is comparing rates. Look at your original loan terms. See how they stack up against today’s rates.

- Check current interest rates: Use online tools to find this information.

- Read your loan agreement: Find your existing rate and compare.

If current rates are lower, refinancing could be a smart move. It means lower payments over the life of your loan. This saves you money.

Identifying The Right Time For Refinancing

Finding the right time to refinance is crucial. It’s not just about rates. It’s about your financial situation too.

| Your Goal | Consider Refinancing If: |

|---|---|

| Lower Payments | Rates have dropped since your original loan. |

| Shorter Loan | You can afford higher payments to pay off your mortgage faster. |

| Cash-Out | You need money for home improvements or debt consolidation. |

Assess your goals and your finances. Market conditions should also be right. Only then should you opt for refinancing.

Credit: peglarrealestate.com

Financial Benefits Of Refinancing

Refinancing a mortgage can seem daunting, but the financial perks are hard to overlook. Homeowners stand to gain several monetary advantages that can substantially impact their financial health. Let’s explore the core benefits that could make refinancing a smart choice for many homeowners.

Reducing Monthly Payments

Refinancing can lead to lower monthly mortgage payments. This move often stretches the loan’s life over a new term, shrinks the interest rate, or changes the loan type. Assessing your current financial situation against potential new loan terms could free up cash each month. Here’s a quick breakdown of how refinancing affects payments:

- Extended Loan Terms: Longer repayment periods lower payments.

- Rates Drop: Securing a lower rate decreases what you owe.

- New Loan Type: Switching from adjustable to fixed rates can offer stability.

Unlocking Lower Interest Rates

Finding a loan with a reduced interest rate can result in significant savings. Interest rates directly influence the cost of borrowing money. A lower interest rate means less paid over the life of the mortgage. Let’s see just how much difference a lowered interest rate can make.

| Original Interest Rate | New Interest Rate | Monthly Savings | Total Savings Over 30 Years |

|---|---|---|---|

| 5% | 3.5% | $150 | $54,000 |

These savings reveal the powerful impact refinancing can have on your budget.

Long-term Savings Opportunities

Refinancing a mortgage offers significant opportunities for homeowners to save money. By selecting the right refinancing plan, individuals can enjoy reduced monthly payments, pay less in interest, and ultimately keep more money in their pockets over the span of their home loan.

Minimizing Total Interest Over The Loan’s Life

One of the most effective ways to save money with refinancing is by reducing the interest paid over the life of a loan. Homeowners can secure lower interest rates, which translate into considerable long-term savings. Here’s how it works:

- Lower interest rates mean reduced monthly payments.

- With each payment, a greater portion goes toward the principal.

- Over time, the total interest paid is significantly diminished.

Shortening Loan Terms: From 30-year To 15-year Mortgages

Altering loan terms from a 30-year to a 15-year mortgage can mean higher monthly payments, but the long-term benefits are clear:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 30-Year | Lower | Higher |

| 15-Year | Higher | Lower |

Choosing a shorter loan term means less interest is accumulated, leading to significant savings. Homeowners often find that the long-term gains justify the increased monthly output.

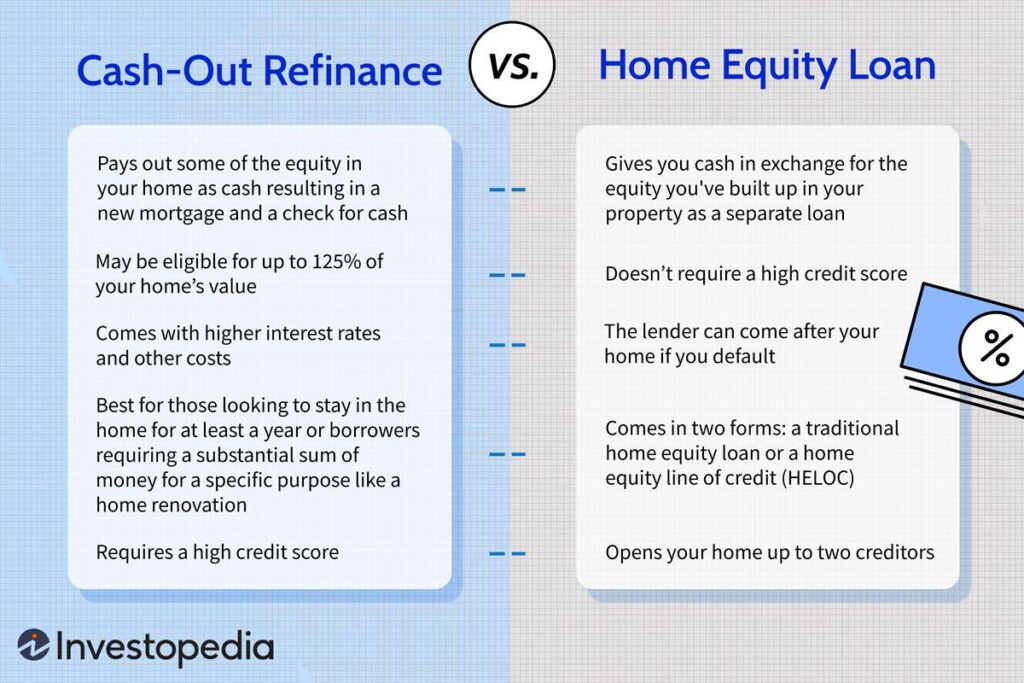

Cash-out Refinancing Explained

Imagine turning your home’s value into actual money. That’s what cash-out refinancing does. It replaces your old mortgage with a new one for more than you owe. The difference lands in your bank account. Ready to learn how this option can transform your financial situation? Let’s dive in.

Accessing Home Equity For Major Expenses

Your house might be your biggest asset. With cash-out refinancing, you tap into the value without selling. Think of it like unlocking a piggy bank. Homeowners often use this cash for major costs. Look below to see common uses:

- Education costs: Pay for college without high-interest loans.

- Medical bills: Cover unexpected health expenses.

- Big purchases: Buy a car or fund a wedding.

Investing In Home Improvements Or Debt Consolidation

Home upgrades can boost your property’s value. They make your space more enjoyable too. Cash-out refinancing can fund these projects. It’s smart money management. You invest back into your home. See the benefits:

| Home Improvement | Benefit |

|---|---|

| Kitchen remodel | Increases home value |

| Addition of a room | Adds living space |

| New roof | Enhances safety and comfort |

Debt consolidation is another reason to refinance. Combine debts into one low-interest loan. It simplifies payments and saves you money.

Adjustable-rate To Fixed-rate Mortgage Conversion

Many homeowners often face a crucial decision: stick with an adjustable-rate mortgage (ARM) or switch to a fixed-rate mortgage? Factors like market conditions and personal financial plans play a big role in this choice. Converting to a fixed-rate mortgage offers benefits in terms of payment stability and financial planning predictability.

Stability In Payments

Monthly payments stay the same when you convert to a fixed-rate mortgage. This change eliminates the worry of fluctuating interest rates and the uncertainty of how much you’ll pay each month.

With an ARM, rates change over time, which can lead to higher payments. Homeowners enjoy consistent payments after converting. This makes budgeting much easier.

Predictability In Financial Planning

A fixed-rate mortgage ensures the cost of your loan is predictable over its entire term. This certainty allows for long-term financial planning.

- Budget more effectively without surprises

- Plan for large expenses without mortgage rate worries

- Secure low-interest rates for the future

With a steady payment schedule, you can plan for life events confidently, knowing your home loan costs won’t change unexpectedly.

Impact On Credit Scores And Financial Health

Understanding how refinancing a mortgage affects credit scores and overall financial health is essential for homeowners. The choice to refinance can bring significant savings and advantages. However, it’s important to be aware of the implications on credit and long-term financial strategy.

Potential Credit Implications Of Refinancing

- Initial Credit Inquiry: Expect a small dip in credit scores due to lender credit checks.

- Number of Accounts: Closing old and opening new loans can affect credit history length.

- Credit Utilization: Refinancing may alter debt-to-credit ratios, a key credit score factor.

- Timely Payments: Consistent, on-time mortgage payments post-refinance boost credit over time.

Strategizing For A Stronger Financial Position

Smart refinancing maximizes financial benefits while minimizing credit impact. Consider the following steps:

- Shop Rates Quickly: Limit credit inquiries within a 14-45 day period to minimize score drops.

- Maintain Old Accounts: Keep older credit lines active to preserve credit history length.

- Plan for Fees: Account for any refinancing costs to avoid financial strain.

- Review Credit Reports: Check for errors before refinancing to ensure a smooth process.

Understanding Closing Costs And Fees

Refinancing a mortgage involves various costs and fees. It’s like setting the reset button on your mortgage, and this reset comes at a price. Homeowners must understand these expenses to make informed decisions. Closing costs cover items like loan origination fees, appraisal fees, title searches, title insurance, and legal fees. They often range from 2% to 5% of the loan amount. To truly benefit from refinancing, your savings should exceed these costs.

Evaluating The Break-even Point

Determining when you’ll start saving money, post-refinance, is key. This moment is your ‘break-even point.’ It’s when your total savings from a lower interest rate surpass the closing costs. Calculate it by dividing the total closing fees by the monthly savings from the new loan. This tells you how many months it’ll take to recoup your expenses.

Saving More Than You Spend

To justify the refinance, savings should outweigh the expenses. Look at long-term interest savings versus upfront costs. If you plan to stay in your home for years, refinancing might offer significant savings on interest payments. Remember, short-term homeowners may not stay long enough to reach the break-even point, making refinancing less beneficial.

| Cost Item | Typical Cost |

|---|---|

| Appraisal Fee | $300-$500 |

| Loan Origination Fee | 0.5%-1.5% of loan |

| Title Search | $200-$400 |

| Title Insurance | $400-$800 |

| Legal Fees | $500-$1000 |

- Estimate closing costs before deciding to refinance.

- Compare offers from multiple lenders to find the best deal.

- Some costs, such as the origination fee, may be negotiable.

- Review the Good Faith Estimate (GFE) for itemized closing costs.

- Assess the Loan Estimate (LE) for detailed loan terms and expenses.

- Examine the Annual Percentage Rate (APR) to understand the true cost of borrowing.

Navigating The Refinancing Process

Navigating the refinancing process is like setting sail on a journey to save money. Homeowners often consider refinancing their mortgage to reduce monthly payments, shorten loan terms, or tap into home equity. The key to a successful voyage is understanding the steps involved and preparing adequately.

Preparing The Necessary Documentation

Preparation is essential before diving into the refinancing pool. Gather all required documents early:

- Proof of Income: Recent pay stubs, W-2s, or tax returns

- Asset Information: Bank statements and investment account balances

- Credit Report: Knowing your credit score helps predict interest rates

- Property Details: Mortgage statements and home insurance policy

Ensuring these documents are at hand will smooth your refinancing journey.

Choosing The Right Lender

Selecting a lender is like choosing a co-captain for your ship. Compare these aspects to make the best choice:

| Lender Feature | Importance |

|---|---|

| Interest Rates | Can greatly affect monthly payments |

| Fees | Include closing costs and origination fees |

| Customer Service | Support throughout the refinancing process |

| Reputation | Reviews and ratings reveal past performance |

Research lender options online and consult with financial advisors to ensure you find the right match.

Beyond The Numbers: Quality Of Life Considerations

Refinancing your mortgage isn’t just about getting a lower interest rate. It’s about enhancing your life. Consider how a revised mortgage can adapt to your personal needs, thus elevating your day-to-day living experience.

Adapting To Life Changes

Life’s constant evolution demands financial flexibility. Refinancing can be the key to unlocking this adaptability.

- New job might require relocation or lower commuting costs.

- Family growth could mean a need for more space or better schools.

- Retirement planning could benefit from lower monthly payments.

Achieving Long-term Homeownership Goals

Refinancing serves as a strategic move to reach your homeownership aspirations.

| Goal | Refinancing Benefit |

|---|---|

| Debt reduction | Consolidate debts, save on interest, and pay off your mortgage faster. |

| Equity building | Switch to a shorter loan term to build equity quickly. |

| Financial security | Tap into your home’s equity for an emergency fund. |

Frequently Asked Questions For Mortgage Refinancing

What Are The Benefits Of Refinancing A Mortgage?

Refinancing a mortgage can lead to lower interest rates, reduced monthly payments, and a shorter loan term. It can also allow homeowners to tap into home equity for cash or consolidate debt, potentially leading to improved financial stability.

How Does Refinancing Save Money?

Refinancing to a lower interest rate decreases the amount of interest paid over the life of the loan. This can result in significant savings. Additionally, restructuring debt or eliminating private mortgage insurance can further reduce monthly expenses.

When Is The Best Time To Refinance?

The best time to refinance is when interest rates drop below your current mortgage rate, your credit score has improved, or you’ve built substantial equity in your home. Economic conditions and personal financial goals also play a crucial part in the decision.

What Costs Are Involved In Refinancing?

Refinancing involves several costs, including application fees, loan origination fees, appraisal fees, title searches, and closing costs. These expenses can vary but typically range between 2% to 5% of the loan amount.

Conclusion

Wrapping up, refinancing your mortgage could usher in substantial savings. It’s smart to weigh the benefits against your financial goals. A lower interest rate, reduced monthly payments, or a shorter loan term might await you. Consider making the switch today; it could be the financial breakthrough your household needs.